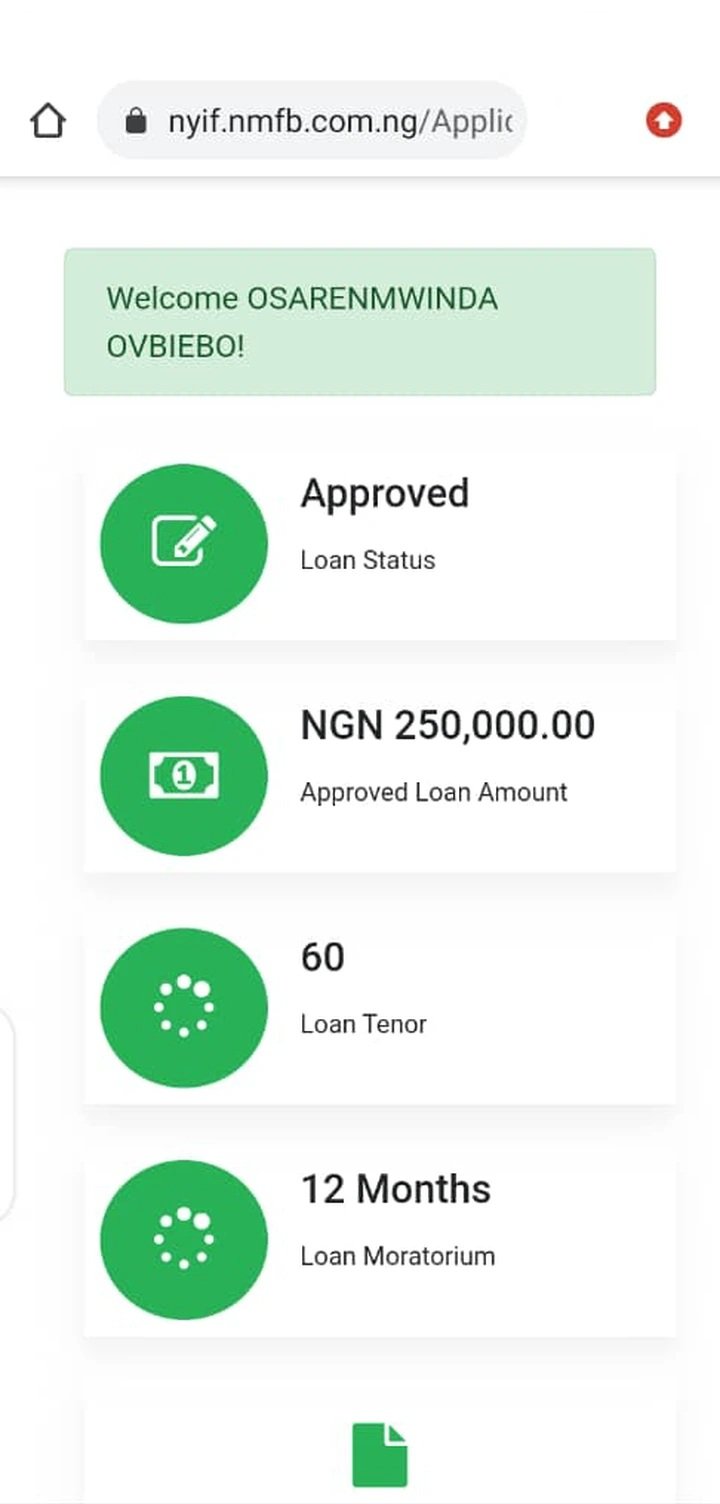

Massive Approval Ongoing, As Nirsal Microfinance Begin Approvals Of Loans, See details Below:

GoldenNewsNg earlier reported that the Nigeria Youth Investment Fund (NYIF) application portal has long been open to candidates wishing to apply for the program.

NYIF was an initiative of the Federal Ministry of Youth and Sports Development (FMYSD) supported by the central bank. Nigeria (CBN). It was built to support the Nigerian economy.

The program aims to harness resources for the ingenious ideas, skills and potential of Nigerian youth by turning them into commercial financial backers.

For individuals who have completed the online business and prepared an evaluation, you can check your pre-status to confirm the offer. When approval began.

When you look at first glance and see that your credit has not been approved at this time, you can stand still as every person who applied and completed the pre-assessment cycle will be approved.

NIRSAL Microfinance Bank Access Target Account

This is a special package offered by Nirsal Microfinance Bank (NMFB), it is a saving scheme and not a loan scheme per say.

In this package, individuals, micro, small, as well as medium-scale enterprises are given the opportunity to develop a healthy saving culture to meet up pressing needs, demands and targets.

The saving scheme runs for a particular duration of time, by which the project or purpose can be achieved. In Access Target Account, NMFB accept savings for the following purposes;

- Rent payment.

- Commodity/goods purchase.

- Purchase of equipments.

- Festivities.

Anyone running this package can make withdrawals during the saving period, but has a limited withdrawal to make depending on the terms (pre-agreed conditions) reached at the beginning.

One can start with an opening balance of a thousand naira (N1,000) or five hundred naira (N500).

How to Apply for Nirsal Loans Package

To access Nirsal Loan, there are some necessary documents/credentials that must be made available. The required documents/credentials are;

- Letter of employment.

- Staff Identity Card.

- Valid means of Identification (i.e National Identity Card, Voter’s card, or Driver’s Licence).

- Pay slip.

- Statement of account from bank (Last 6 months).

- Any utility bill.

- Two recent passport photograph.

- A signed guarantor’s form.

Review Nirsal Loans

Advantages

- Nirsal Loan usually have a broader range of Loans they give out.

- They gives competitive rates to their Loans

Disadvantages

- Large amount of loan requires lots of paperwork.

- There is need for a guarantor, when applicants chooses a special loan package.

- Recipients are entitled to compulsory training.

We believe from the thorough explanations given about the various loan packages offered by NMFB, you can easily opt in for you preferred package, or enlighten someone else out there about it

For more information on Nirsal Nigeria’s youth investment funds and other news, follow us.