Need a Bank Loan to Support your Business? Apply for LPO/Invoice Discounting Finance (IDF) Loan without Collateral in Nigeria.

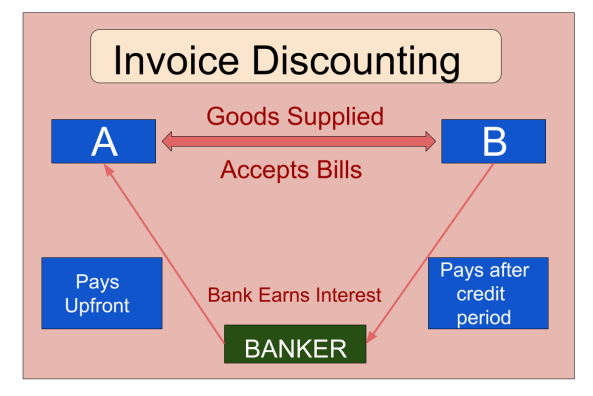

GoldenNewsNg learnt that Invoice Discounting Finance (IDF) is a short-term loan offered by banks to their corporate and commercial customers who have completed contracts and issued invoices to their own clients but are yet to get payments.

In clearer terms, the IDF is a ‘stop-gap’ loan issued to a company to support its cash flow pending when a payment for a job done comes in. it is also refer to as ‘LPO financing without collateral’ or ‘purchase order financing’.

How to Apply for Invoice Discounting Facility (IDF) loan from your Bank in Nigeria

All Nigerian commercial banks have this product, and it is made available for all types of corporate customers.

Basically, you will need to speak with your account officer and also provide the necessary documents to enable the bank credit analysts to do a review of your business and contracts.

Here are the basic documents required to get an Invoice Discounting Facility loan from any bank in Nigeria:

- Company bio

- Application letter

- Evidence of past jobs done

- Invoices to be discounted (if any)

- Signed purchase order (PO/LPO)/signed contract

- 3-year cash flow projection

- Other bank(s) statement of account (if any)

- Letter of irrevocable domiciliation of contract proceeds from the contract employer

Note that the bank may only ask for tangible collateral covering the entire requested borrowing limit if the contract employer* (who issued the Purchase Order) isn’t a registered counterparty* of the bank.

Features of Invoice Discounting Finance Loan

As a tailored loan type, the features of the IDF loan may be similar across all commercial banks – but not the same. Here are a few of the features of an ideal IDF loan:

- For a line*, the maximum tenor is 12 months (varies by bank)

- At each invoicing, clean-up cycle* is 30-60 days.

- Banks discount only up to 70-80% of confirmed invoices presented per time. (varies by bank)

- Repayment is bullet*

- Current industry interest rate for IDF loan is 16 – 20%. (varies by bank and other terms of the loan)

All terms with (*) are explained below.

Explanation of Terms

- Contract employer – The issuer of a Purchase Order

- Counterparty – A well known customer-company to the bank.

- Line – A facility that is an arrangement between a bank and a customer that establishes a pre-set borrowing limit that can be drawn on repeatedly within a period of time.

- Clean-up cycle – This is the time frame given to the customer to repay a discounted invoice. The clean-up cycle must be in alignment with the contract employer’s payment terms.

- Bullet repayment – A lump sum payment made for the entirety of the outstanding invoiced loan amount.