Are you interested in getting quick loans with no collateral and minimal interest rate, from the comfort of your home or office? There are .

With Online loan apps getting a Loan for business, Emergencies, Health issues, and other unforeseen issues has been made easy, with easy repayment plans, minimal documentation, low interest rates, and quick disbursal.

Recommended: Checkout Interest rates of some Loan in Nigeria & How to Apply

- Kuda Loan

Kuda is a bank just like First Bank, wema bank, Access Bank, and every other bank in Nigeria.

Kuda Bank is a monetary company that is solely online and carries out financial operations with a banking license from the Central Bank of Nigeria.

How To Get Kuda Loan.

Kuda Bank offers loans for their active users. If you are active on the Kuda Bank mobile app, you will be able to get a loan quickly.

Yes: with Kuda Bank, it’s possible to take quick short-term loans without doing any paperwork.

Also, you can decide to pay them back at any time, with just 0.3% daily interest.

If you are ready, here’s how to apply for a Kuda Loan.

- Go to Google Play Store, and search for “Kuda bank”

- Install and Open the Kuda app, then swipe to your borrowed account.

- Click on borrow.

- Click on Get your Overdraft.

- Touch next, to proceed

- Now Input the amount you want to borrow and then click done.

- You will be asked to enter your PIN.

- Verify your transaction PIN.

- You can also use Face or fingerprint to verify the transaction.

- Now click on okay.

- And transfer your money to any bank.

Recommended: List of Federal Government loan to start your business within Nigeria

2. Blocka Cash

Blocka Cash provides easy loans in Nigeria. Blocka Cash is available on the Android app store and the Apple app store.

You can access short-term loans on Blocka from at least N5,000 and up to N50,000 depending on your credit score.

The requirements for a Blocka cash loan include:

- You must be at least 21 years of age.

- You might need to provide a valid Government

- Interest rate: 3% per month – of 10% per month

- Annual Percentage Rate (APR): 36% to 120%.

- Loan tenure: 60 to 180 days

- Repayment channels: Debit Card, Quickteller, and direct transfer

New Loan Apps in Nigeria

3. Migo

Migo was Formerly Kwikmoney, Migo is a very popular lending company in Nigeria. You can get a mobile loan in Nigeria of up to N500,000 with Migo in a few minutes in Nigeria. Over N40 billion Naira has been borrowed from Migo. The interest rate for a Mogo loan is 5 % to 15%.

4. Lidya

Lidya loans allow you to expand your business and generate more income. The platform provides financing based on the cash flow in your bank account and without collateral. Lidya offers businesses credits of $500 and $50,000.

- Requirements: Own a business.

- Platform: Web

- Interest Rate; Unspecified (The company claims they are affordable)

- Loan tenure: Depends on the loan amount

- Multiple loans at a time: No

- Repayment channel: Debit Card, Direct Deposit.

5. JumiaPay

JumiaPay is a product of Jumia, which gives instant loans to its users.

to access the loan, You can download the app on Playstore, create your account, scroll down to the ‘Financial Services’ section, and click ‘Loans’ to apply for a quick loan.

Details are displayed on the website: pay.jumia.com.ng/services/loans.

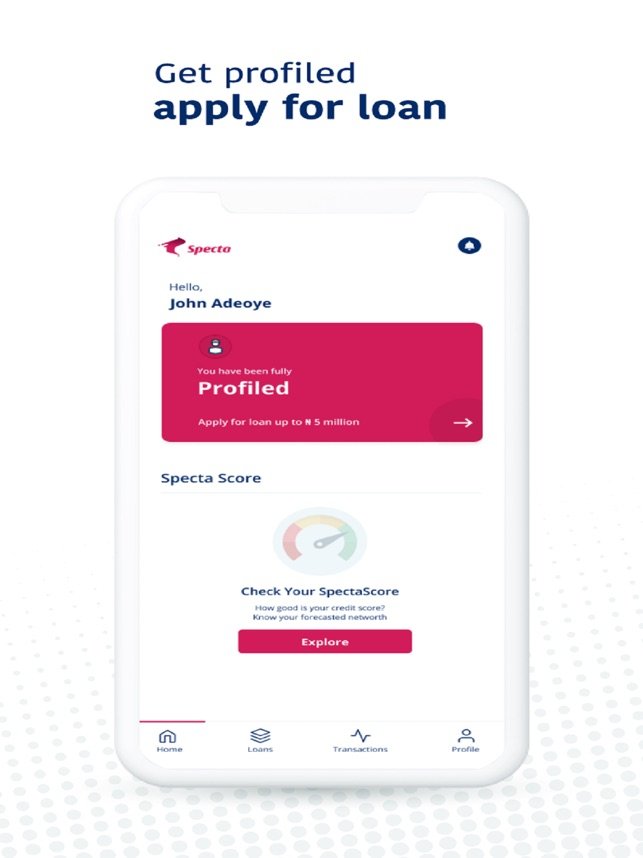

6. Specta

Specta is owned and managed by a financial institution, Sterling, and does not require any collateral, guarantor, or bank visit to access quick loans.

Irrespective of your occupation or bank, you can access a loan amount of up to ₦5,000,000 to meet your financial needs.

The app can be downloaded on Playstore and has other interesting packages for you. For more details about Specta loans check out our review of Specta.

7. Kredi Loan

Kredit loans provide financial support to both individuals and enterprises to ensure the smooth operation of the business. The Kredi loan is divided into four sections. They are as follows:

a. Kredi SME (Small and Medium-sized Enterprises) loan: With this product, you can get a loan for your firm without putting up any collateral. This loan can be used to start, grow, rescue, or expand your company.

b. Kredi Nano-Loan: Nano-loans are modest, short-term loans that can help you save money when you need it. Simply said, regardless of whether you get a wage or not, this product allows you to access up to NGN 100,000.

c. Kredi Salary-Backed Loan: This product is only available to salaried individuals. You can borrow up to N5 million with a repayment period of 18 months if you take up a salary-backed loan.

d. Kredi Collateral-Backed Loan: These loans have collateral attached to them as security. Customers can also get instant bank loans without putting up any collateral.

How do I apply for a Kredi loan?

Follow the procedures below to get a loan on Kredi:

- Get the Kredi app on your phone.

- Create an account by filling out the app’s registration form.

8. Aella credit

Aella Credit, which gives loans up to 1M, Interest range: 6% – 20%, Loan tenure: 1 – 3 months with no late/rollover fees.

You can download the app from Playstore (Android), or App Store (iOS) or check Aella for more information.

9.FINT

FINT is a loan marketplace matching lenders looking for competitive returns with credit-worthy borrowers (individual or business loans) looking for the most attractive interest rates possible.

FINT is the leading loan marketplace in Nigeria. It connects lenders looking for high returns with creditworthy borrowers looking for short-term personal loans or business opportunity loans.

Fint boasts of simple, affordable, and quick Loans. You can borrow between ₦20,000 – ₦1,000,000 with fixed Term – 3, 6 or 12 months. Pay back principal and interest monthly and enjoy low interest rates (as low as 2% monthly). No collateral required

10.C24 Limited

C24 Limited is a microfinance institution that was established with the sole mission of creating an avenue for people to actualize opportunities around them, by helping them access quick loans when they need it.

C24 is similar in service to Zedvance because personal Loan is made available to employees whose employers have endorsed their employees’ loan applications. This loan typically does not require any security, usually processed very quickly, in some cases the repayment terms are more flexible than a Personal Loan.

With the above review, you can make a choice of which quick loan app you will patronize. However, making a good financial decision is very important to your financial success. Consider what you have been offered properly before you proceed and make sure you will be able to pay back at the stipulated time before taking up a loan.