In recent years, Nigerians have increasingly turned to mobile banking solutions, causing a significant shift in the banking landscape.

Traditional banks have faced challenges as a considerable number of their customers transition to more accessible and user-friendly banking platforms.

Among the benefits offered by challenger banks, access to high-quality savings and investment opportunities stands out prominently.

In this article, we delve into 10 savings apps offering high-interest rates in Nigeria, empowering users to make informed decisions about their financial future.

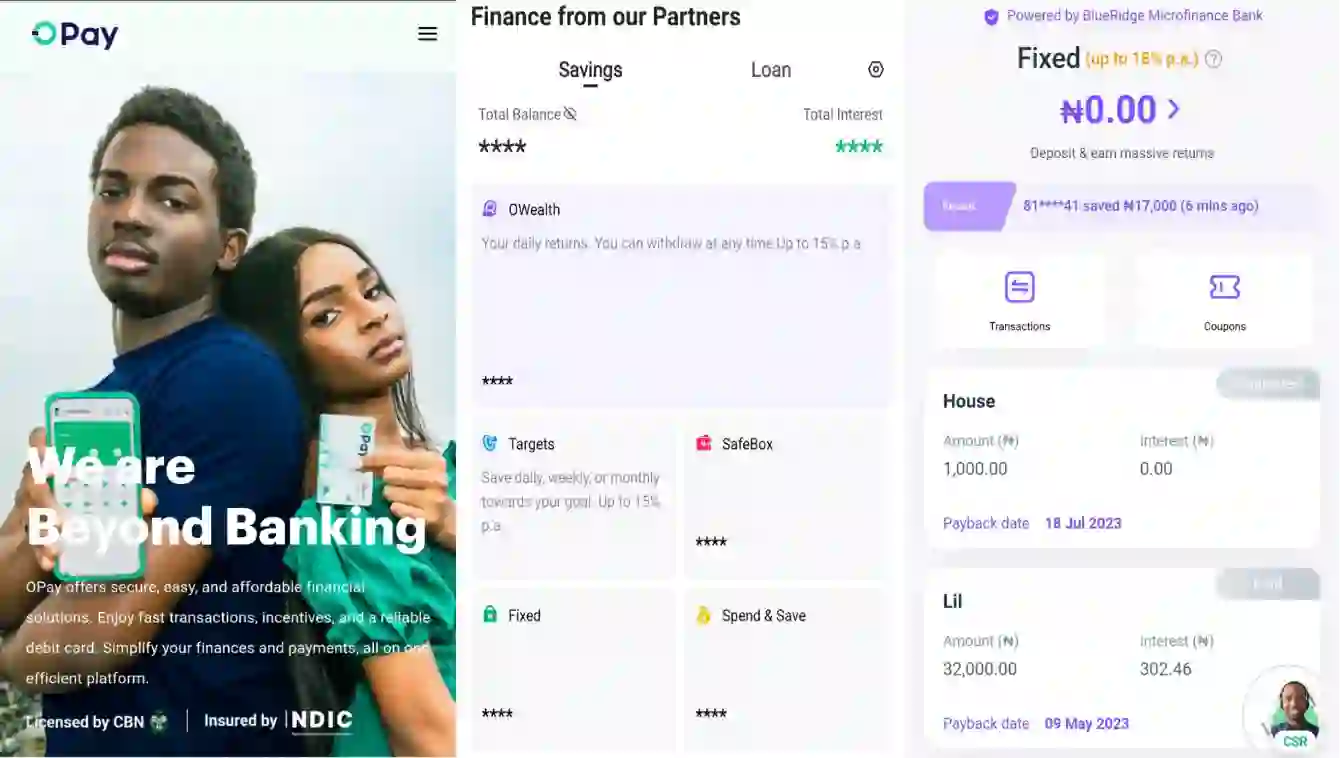

1. Opay

Opay, Africa’s largest fintech platform boasting over 20 million app users, is primarily known for its banking services and POS machines. However, within the app lies a savings feature enabling users to save and earn interest on their funds.

Savings Plans:

- Owealth

- Fixed

- Target

- Safebox

- Spend & Save

Opay offers competitive annual interest rates, with fixed savings potentially reaching up to 18% depending on the duration and amount saved.

Accessibility & Ease of Use: Opay’s savings feature is available on both Android and iOS platforms and is designed to be user-friendly, catering to individuals of all levels of financial literacy.

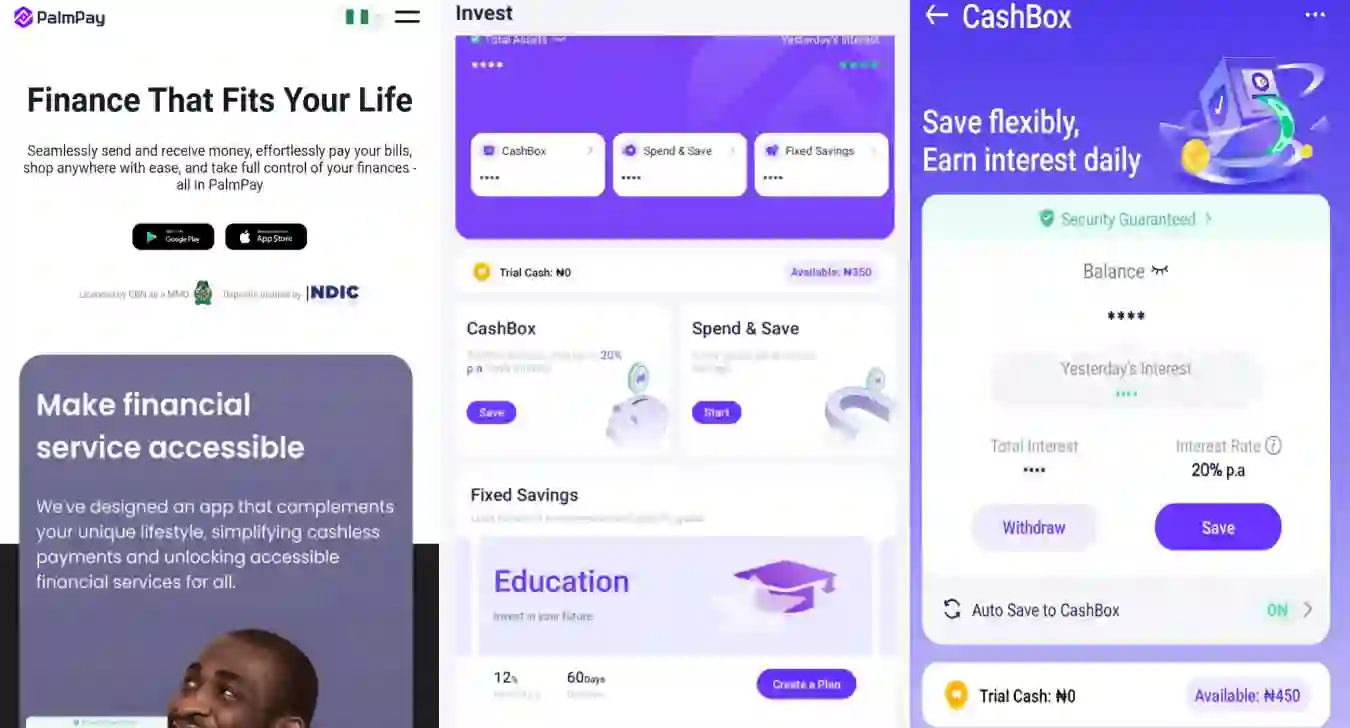

2. Palmpay

Palmpay has emerged as a dominant force in the Nigerian mobile money space, offering low transaction fees, zero monthly maintenance charges, and lightning-fast transactions. Recently, they launched their savings products, providing users with convenient and efficient financial solutions.

Savings Plans:

- Cashbox

- Fixed

- Spend & Save

With interest rates ranging from 8% to 20% annually, Palmpay’s savings plans cater to various savings needs, from short-term goals to long-term investments.

Accessibility & Ease of Use: Available on both Android and iOS, Palmpay’s savings feature is accessible and intuitive, ensuring a seamless user experience.

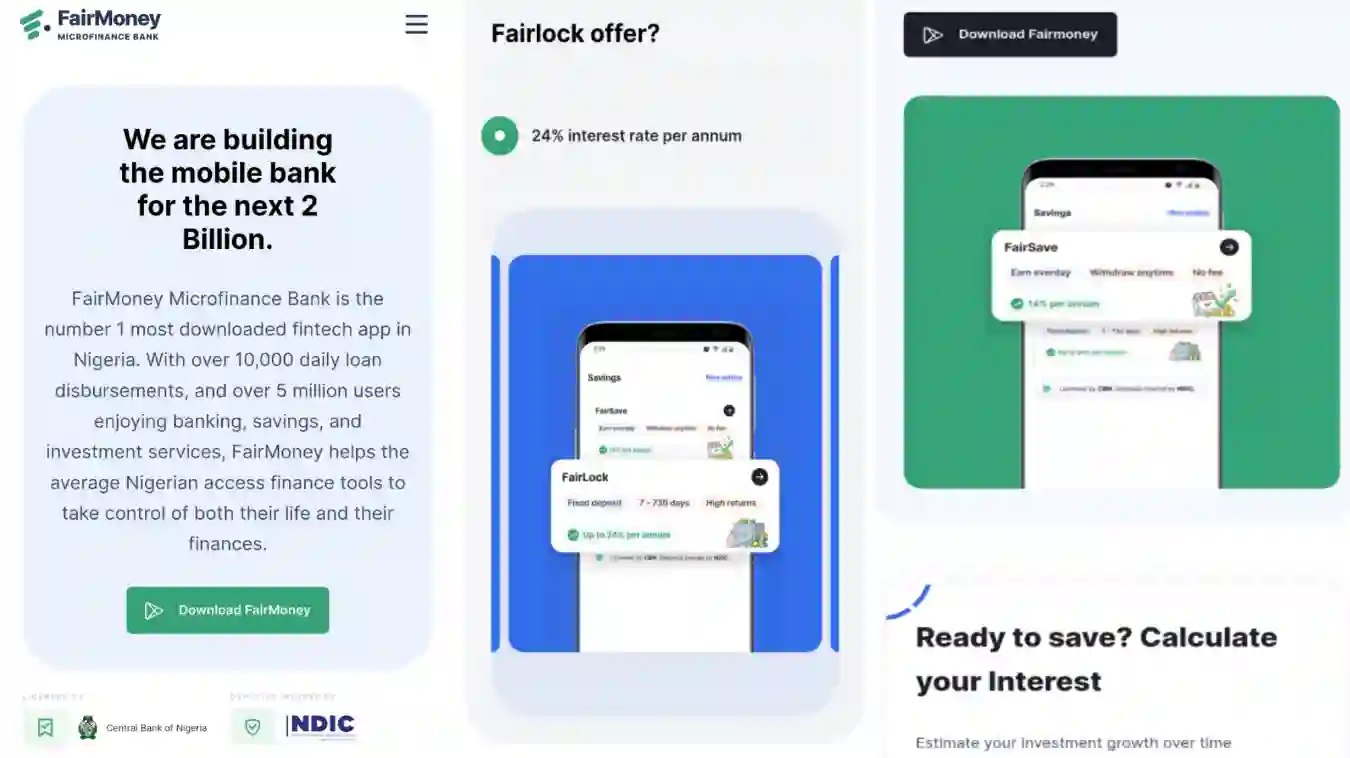

3. Fairmoney

Fairmoney, initially known as an emergency loan app, has evolved into a comprehensive financial services provider, offering savings products since 2022. With a focus on accessibility and inclusivity, Fairmoney’s savings options cater to a diverse range of users.

Savings Plans:

- Fairsave

- Fairtarget

- Fairlock

Offering interest rates of up to 24% annually, Fairmoney provides flexible savings solutions tailored to individual preferences and financial goals.

Accessibility & Ease of Use: Available on Android and iOS, Fairmoney’s savings feature offers simplicity and convenience, ensuring a hassle-free savings experience.

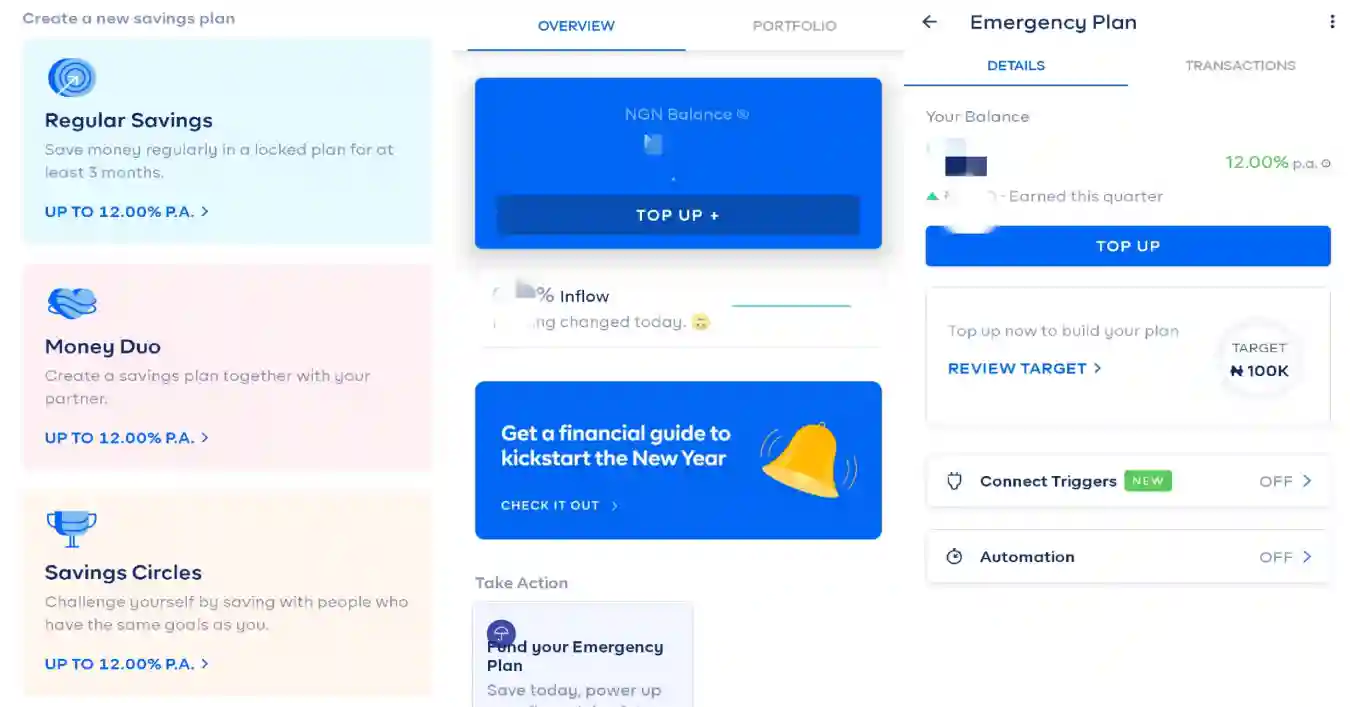

4. Cowrywise

Distinguished by its exclusive focus on savings and investment, Cowrywise has garnered the trust of Nigerians with over 1 million downloads and a growing user base. Offering a range of savings plans, Cowrywise empowers users to take control of their financial future.

Savings Plans:

- Emergency savings

- Regular savings

- Money Duo

- Savings circle

With an annual interest rate capped at 12%, Cowrywise provides users with competitive returns on their savings, facilitating financial growth and stability.

Accessibility & Ease of Use: Available on both Android and iOS, Cowrywise’s user interface could be improved for enhanced usability, but it remains a reliable platform for savings and investment.

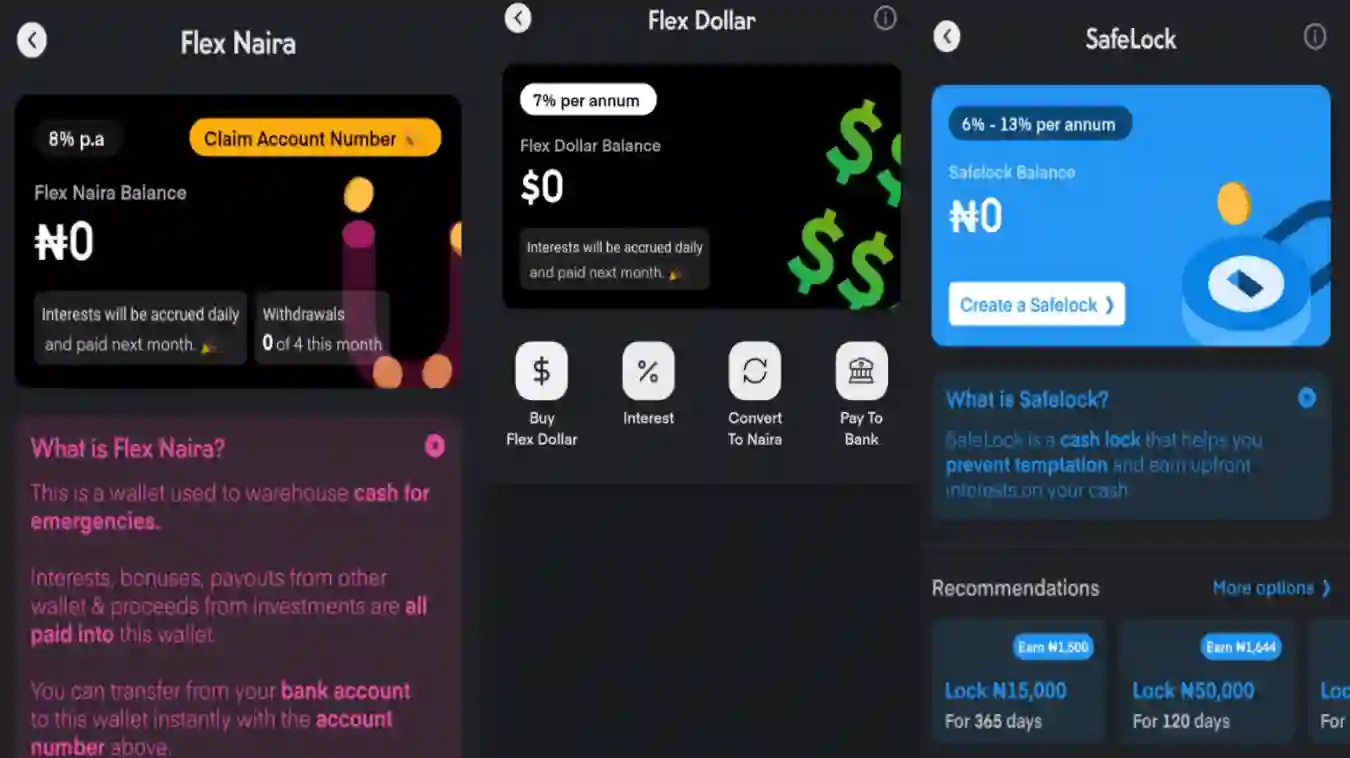

5. Piggyvest

Operating exclusively in the realm of savings and investment, Piggyvest has established itself as a trusted platform over its seven years of existence. With multiple savings modes catering to diverse needs, Piggyvest offers users flexibility and convenience in managing their finances.

Savings Plans:

- Piggybank

- Safelock

- Flexnaira

- Target savings

- Flex Dollar

Boasting interest rates ranging from 7% to 13% annually, Piggyvest empowers users to earn attractive returns on their savings while achieving their financial goals.

Accessibility & Ease of Use: Available on both Android and iOS, Piggyvest’s intuitive interface makes it accessible to users of all levels of financial literacy.

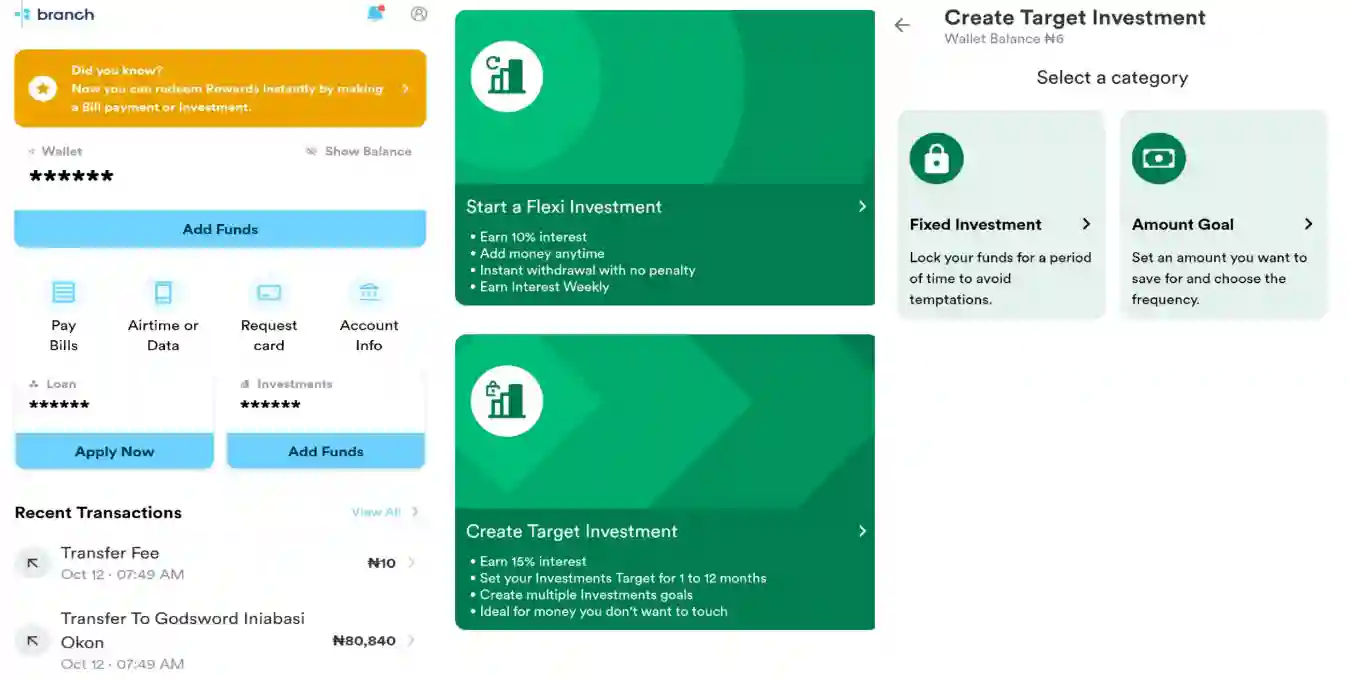

6. Branch International

Originally known for its emergency loan services, Branch International has expanded its offerings to include savings products, catering to the evolving needs of its users. With a focus on simplicity and accessibility, Branch International provides users with easy-to-use savings solutions.

Savings Plans:

- Flexi

- Locked savings

- Target savings

Offering competitive interest rates of up to 15% annually, Branch International enables users to earn returns on their savings while maintaining liquidity and flexibility.

Accessibility & Ease of Use: Available exclusively on Android, Branch International offers a seamless user experience, ensuring smooth navigation and operation.

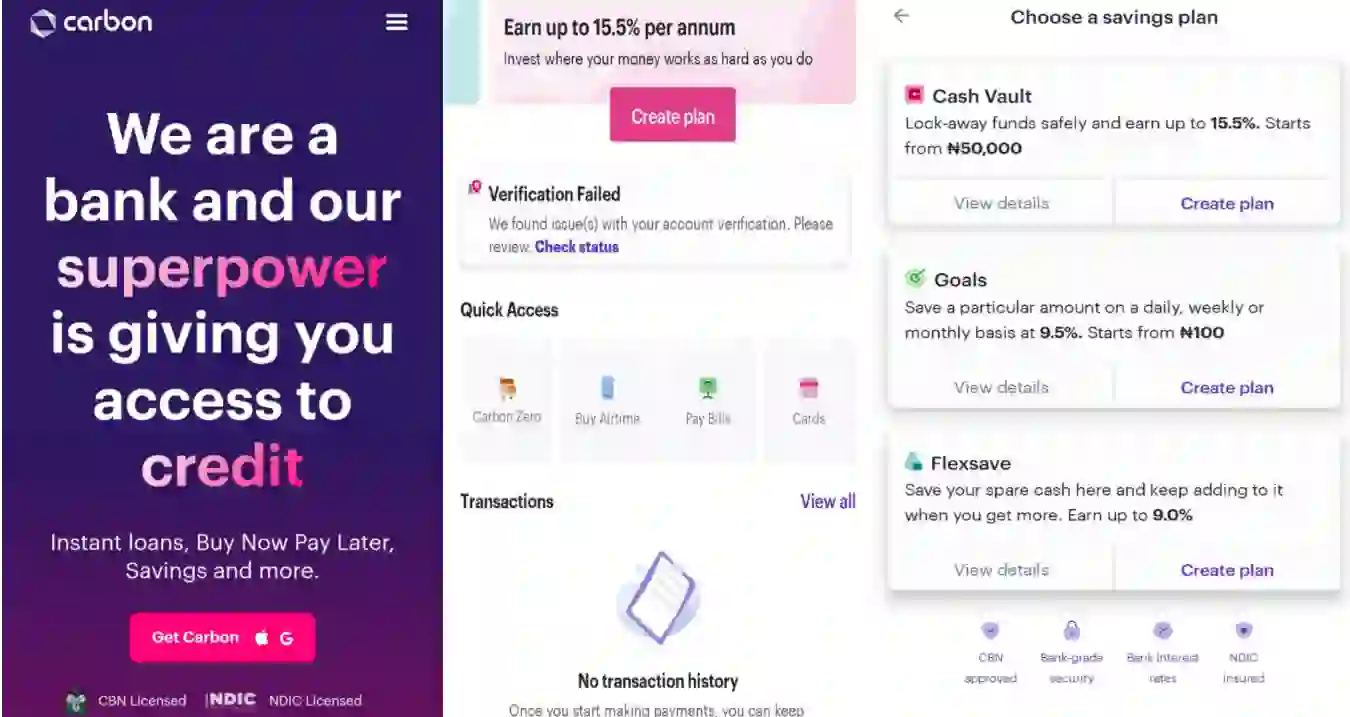

7. Carbon

Formerly known as Paylater, Carbon has evolved into a comprehensive financial platform offering a range of banking services. With a focus on simplicity and accessibility, Carbon’s savings products cater to users seeking convenient and efficient financial solutions.

Savings Plans:

- Cash vault

- Goals

- Flexsave

Offering interest rates of up to 15.5% annually, Carbon provides users with competitive returns on their savings, promoting financial growth and stability.

Accessibility & Ease of Use: Available on both Android and iOS, Carbon’s user-friendly interface ensures a seamless savings experience for users.

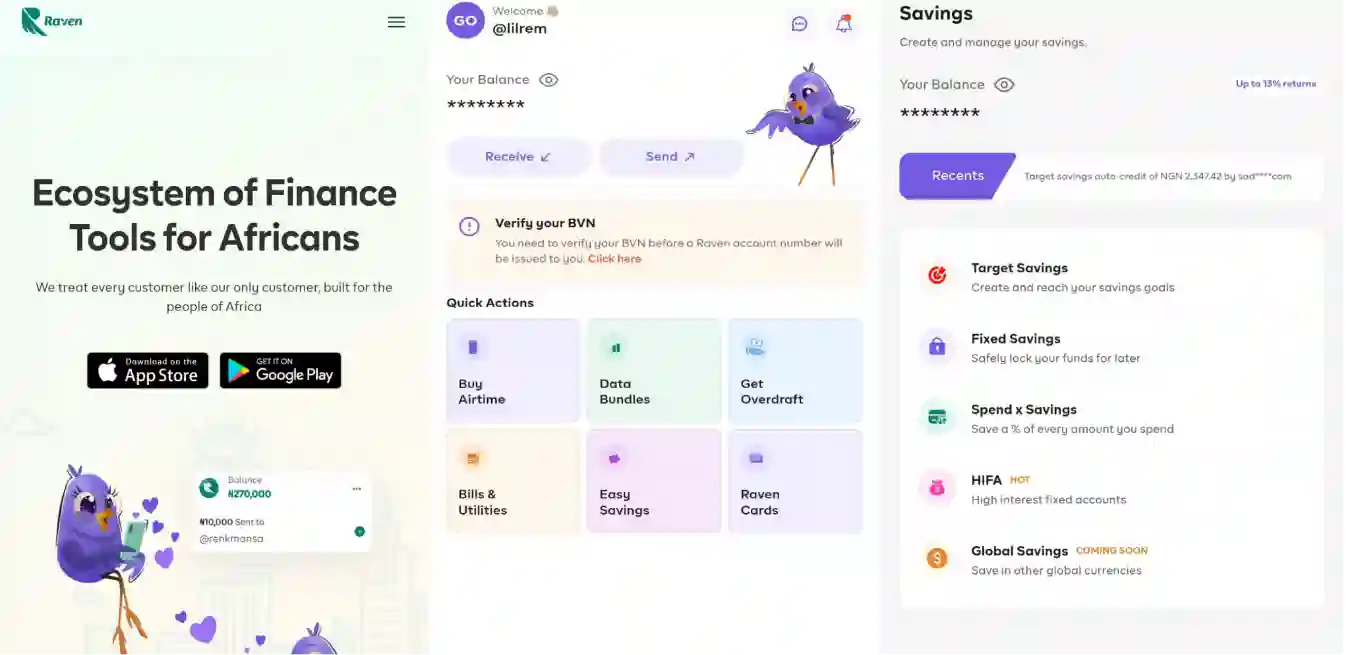

8. Raven

As one of the newest entrants in the fintech space, Raven has quickly gained traction with its comprehensive suite of banking services. Offering a range of savings plans, Raven empowers users to achieve their financial goals with ease.

Savings Plans:

- Target

- Fixed

- Spend & Save

- HIFA (High Interest Fixed Accounts)

With interest rates ranging from 5% to 18% annually, Raven provides users with attractive returns on their savings, facilitating financial growth and stability.

Accessibility & Ease of Use: Available on both Android and iOS, Raven’s modern interface ensures a seamless user experience, enabling users to navigate the platform effortlessly.

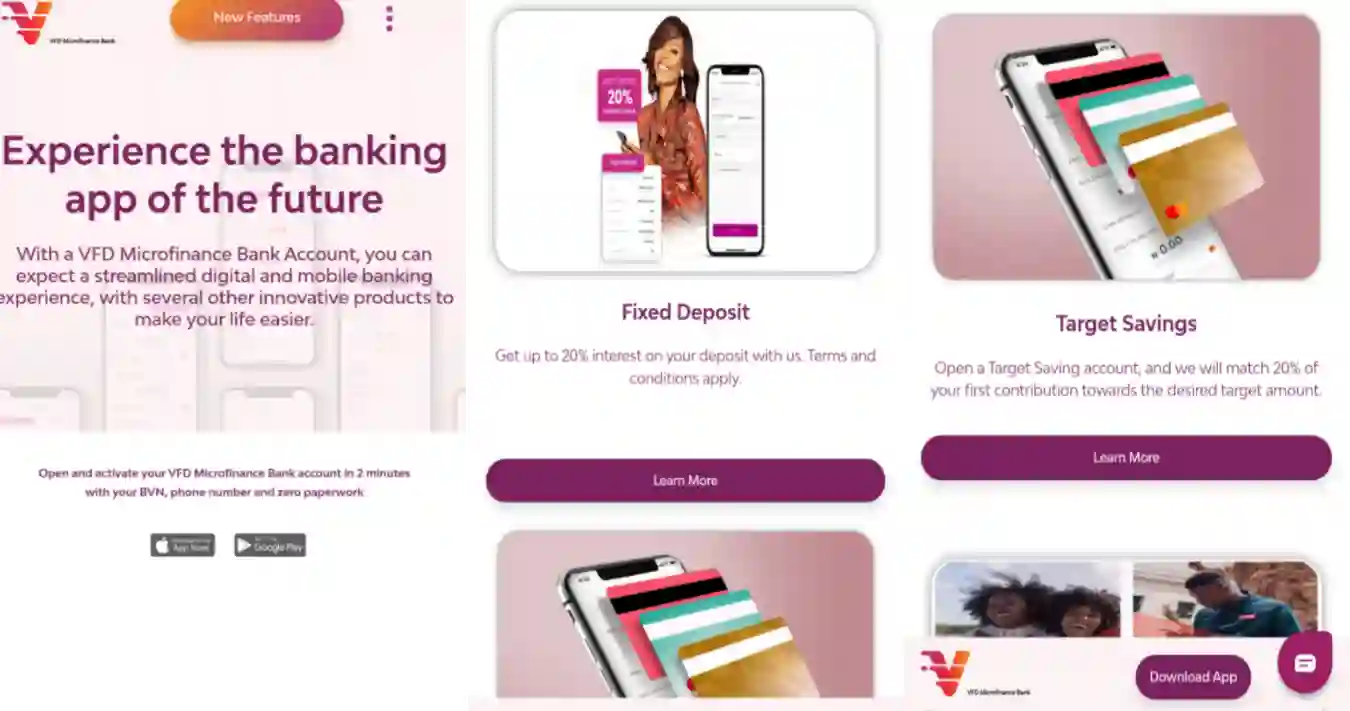

9. V by VFD

Since its launch in 2020, V by VFD has emerged as a leading online banking platform, offering users a comprehensive suite of banking services. With a focus on simplicity and accessibility, V by VFD’s savings products cater to users seeking convenient and efficient financial solutions.

Savings Plans:

- Target

- Fixed

- Crew savings

Offering competitive interest rates of up to 20% annually, V by VFD provides users with attractive returns on their savings, promoting financial growth and stability.

Accessibility & Ease of Use: Available on both Android and iOS, V by VFD’s intuitive interface ensures a seamless savings experience for users.

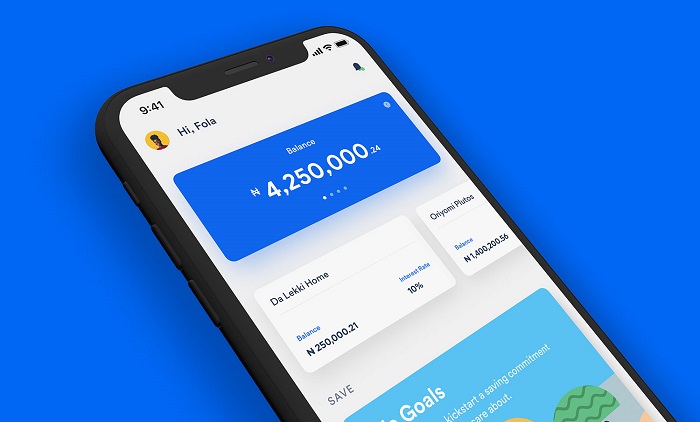

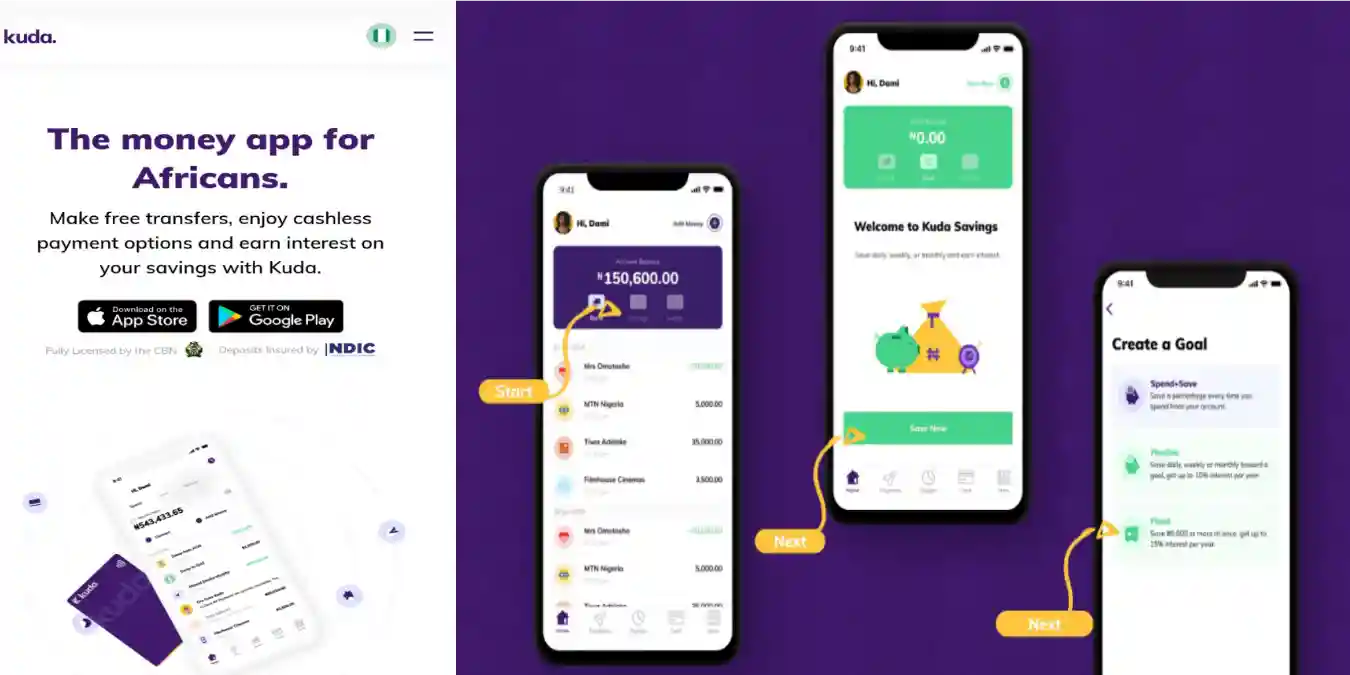

10. Kuda MFB

Kuda MFB has emerged as a prominent microfinance bank, offering users a range of banking services through its user-friendly mobile app. With a focus on simplicity and accessibility, Kuda MFB’s savings products cater to users seeking convenient and efficient financial solutions.

Savings Plans:

- As you want

- Frequently

- Spend and save

- Fixed Deposit

With interest rates ranging from 5% to 8% annually, Kuda MFB provides users with competitive returns on their savings, promoting financial growth and stability.

Accessibility & Ease of Use: Available on both Android and iOS, Kuda MFB’s modern interface ensures a seamless user experience, enabling users to manage their finances effortlessly.

Conclusion

In conclusion, Nigerians have access to a diverse array of high-interest savings apps, each offering unique features and benefits. Whether users prioritize high returns, convenience, or flexibility, there is a savings app tailored to their needs.

By exploring the options available and selecting the platform that aligns with their financial goals, users can take control of their finances and work towards a secure and prosperous future.