This article contains information on the Best Pension Funds Management in Nigeria 2021.

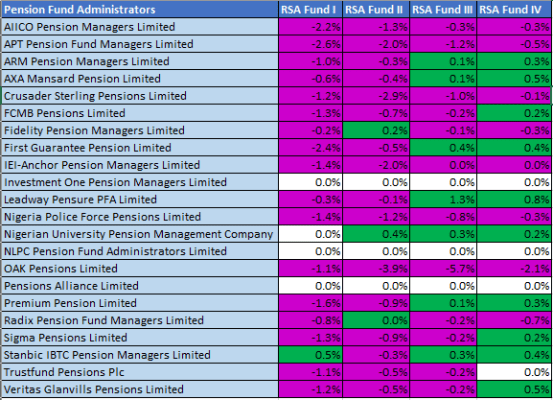

According to Nairalytics research, the performance of most Nigerian Pension Fund administrators in the month of February across the different funds dipped significantly as only 22% of the funds recorded positive growth in the month.

Best Pension Funds Management in Nigeria 2021

Below is a list of the best-performing funds in February 2021;

RSA Fund I

This fund has the highest allocation of risky or variable income instruments and participation is strictly upon a formal request from a contributor. The RSA Fund I is suitable for persons who want to invest in high-risk instruments with higher rewards. Hence, contributors who are 50 years and above cannot apply to be moved into this fund.

According to available data, only Stanbic IBTC Pension Manager Limited recorded positive growth in the month of February 2021, growing by 0.5% to close at N1.7223.

Name of PFA: Stanbic IBTC Pension Managers

It is worth noting that, the information of Investment one Pension Managers was not available on their website, while that of NLPC Pension Fund Administrators and Pensions Alliance Limited could not be computed. Other administrators in this category recorded a decline in the review month.

RSA Fund II

This fund is balanced and suitable for middle-aged contributors as well as those with a medium risk appetite. It is designed to be less risky with reduced allocation to variable income instruments compared to Fund I. The age requirement for participation is 49 years and below.

First Position: Nigerian University Pension Management

Second Position: Fidelity Pension Managers Limited

Third Position: Radix Pension Fund Managers Limited

As was the case with the RSA Fund I, Information on Investment One Pension Managers could not be obtained from the website, while NLPC and Pensions Alliance Limited could not be computed. Others on the list recorded a decline in February 2021.

RSA Fund III

This is a conservative fund that is designed for contributors close to retirement and contributors with a low-risk appetite. It is suited for contributors between the ages of 50 and 60 years. However, younger contributors may opt to participate in this fund category.

First Position: Leadway Pensure PFA Limited

Second Position: First Guarantee Pension Limited

Third Position: Nigerian University Pension Management Company

RSA Fund IV

The RSA Fund IV is exclusively for retirees. In the month of February, of all 22 Pension Fund Administrators, 10 of them recorded positive growth. However, they were all marginal growth of less than 1%.

First Position: Leadway Pensure PFA Limited

Second Position: Veritas Glanvills Pensions Limited

Third Position: AXA Mansard Pension Limited

A cursory look at the Q4 2020 Pension industry report shows that the total value of Pension Fund assets was N12.31 trillion as of 31st December 2020, comprising of N8.51 trillion for the RSA active funds, N962.66 billion for the RSA Retiree fund, N1.56 trillion for the CPFAs, and N1.27 trillion for the approved existing schemes.

Credit: Nairametrics