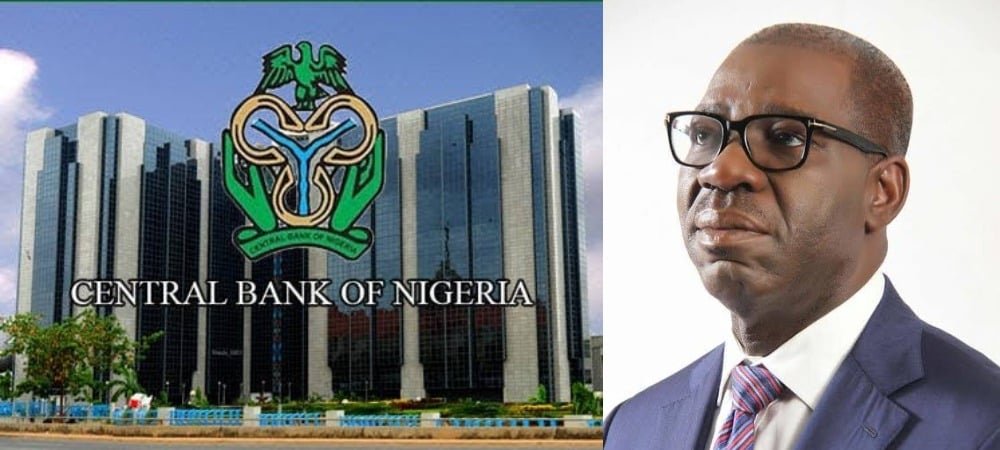

Following Obaseki’s allegation of printing N60 billion, CBN has threatened States With Pandemic Intervention Loans Recovery

GoldenNewsNg gathered that the Central Bank of Nigeria (CBN) has threatened state governments with the immediate recovery of the pandemic intervention loans extended to aid them to fund their budgets following the effect of the coronavirus on their revenues.

Report has it that Edo State’s Governor Godwin Obaseki publicly announced that the federal government had printed N60 billion to augment the FAAC allocation (Revenues shared amongst the federating units and the federal government) for March. A claim the Minister of Finance, Budget and National Planning, Zainab Ahmed described as “sad and “untrue”

CBN Governor, Godwin Emefiele, in his response to the claim by Obaseki (an Investment Banker before turning politician), told journalists that the “Central Bank will call back stimulus loans issued to state governments which could perhaps mean deducting the loans from the monthly Federal Allocations shared between states and Federal Government.”

He also announced that the apex bank was working to include sugar and wheat on the list of commodities that would be restricted from accessing foreign exchange.

Speaking in Nasarawa State during an inspection tour of the proposed $500 million Dangote sugar processing facility, Emefiele explained that: “States and Federal Government have faced severe economic challenges over the last year as COVID-19 Pandemic and the fall in oil prices hurt government revenues.

“To continue running the government, the Central Bank lent trillions of naira to the Federal and state governments through several intervention funds often backed by the Ways and Means provisions which allow the apex bank to lend money to the government.”

Emefiele who attempted to explain the concept of printing money, said: “If you understand the concept of printing of money. Printing of money is about lending money; that is our job. To print is about lending money.

“Money printing in economic terms is also referred to as quantitative easing and occurs in a period of a recession or economic crunch. Central banks pump money into the economy by either buying bonds or crediting the accounts of banks or the government in the hope that this will spur economic growth. The money is often repaid via tax receipts when the economy recovers. The United States recently doled out over 1 trillion to Americans to help them recover from COVID-19.

“If you understand the concept of printing of money, it is about lending money. That is our job. To print is about lending money.

“So, there is no need of putting all the controversy about printing of money as if we go into the factory, print the naira and start distributing on the streets.

“It is very inappropriate for people to give colouration to printing of money as if it is some foreign words coming from the sky.

“It’s important for me to put it this way that in 2015/16, the kind of situation we found ourselves in, we did provide a budget support facility to all the states of this country.

“That loan is still unpaid up till now. We are going to insist on them paying back the money since they are accusing us of giving them loans.”

Report also has it that Gov. Obaseki told his state transition committee members that, “When we got FAAC for March, the Federal Government printed an additional N50-N60 billion to top-up for us to share. This April, we will go to Abuja and share. By the end of this year, our total borrowing is going to be between N15 and N16 trillion. Imagine a family that is just borrowing without any means to pay back and nobody is looking at that, everybody is looking at 2023, everybody is blaming Mr. President as if he is a magician.”

Ahmed, had chastised the governor for making such a comment explaining that “the issue that was raised by the Edo State Governor for me is very, very sad because it is not a fact… What we distribute at FAAC is revenue that is generated and in fact distribution revenue is public information. We publish revenue generated by FIRS, the customs, and the NNPC and we distribute at FAAC. So, it is not true to say we printed money to distribute at FAAC, it is not true.”

On forex restriction for selected commodities, Emefiele said, “We are looking at sugar and wheat. We started a programme on milk about two years ago. Eventually, these products will go into our forex restriction list.”

He said the CBN’s decision to include sugar and wheat on the forex restriction list was because the country spends $600 million to $1 billion importing sugar annually.