How To Check Your NMFB NIB Window Loan Approval Status

Are you one of the Nirsal Microfinance Bank Non-Interest Banking Loan beneficiaries? if yes, then this article is for you, we will be walking you through how to check your Nirsal Microfinance Bank Non-Interest Banking Window Loan approval status, keep reading.

How To Check Your NMFB NIB Window Loan Approval Status: How To Check Your NMFB NIB Window Loan Approval Status,Who Is Eligible To Access NMFB Non-Interest Banking Window Loan,, What is the Repayable Plan,Four Important Things To Know About NMFB Non-interest Banking Window Loan

The Nirsal Microfinance Bank non-interest banking loan is for businesses and households that have been impacted negatively by the Covid-19 pandemic. It was the decision of the Central Bank of Nigeria (CBN) to extend a non-interest window to businesses and households that have been impacted negatively by the Covid-19 pandemic.

Applicants are to note that the NMFB shortlisting of successful applicants for the Non-interest banking loan is still ongoing and applicants have started accepting their offers.

Appplicants who are yet to know their application status, should kindly follow the below steps:

How To Check Your NMFB NIB Window Loan Approval Status

If you are one of the Nirsal Microfinance Bank Non-Interest Banking Window Loan applicants and have not gotten any message of approval, you don’t need to panic as approval is still going on.

Nirsal Microfinance Bank has not provided a portal or link for applicants to check their loan status, you will only receive a text message of approval if your loan is approved.

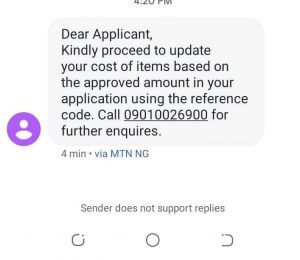

If you received a text message on your approval without a link in the text, kindly wait for another text message that will contain your approval link.

For Some applicants who are receiving a text from NMFB to go back to the Nirsal Microfinance portal to update the cost of items approved to them, If you received such a message visit the Nirsal loan portal click on Returning Applicant fill the spaces for BVN, Last Name and Reference Number you used during the registration, click next to reduce the cost of items you fill so that it will equal the 500,000 amount eligible for a household loan.

Who Is Eligible To Access NMFB Non-Interest Banking Window Loan

MSME’s with 1-5 staff and verifiable evidence of business activities adversely affected as a result of the pandemic with evidence of job protection for its staff.

Hospitality businesses, health (pharmaceuticals and medical supplies) Airline service providers, manufacturing/value addition, trading, and any other income-generating activities as may be prescribed by CBN are Shari’ah compliant.

What is the Repayable Plan

3 years tenure with a moratorium of six months.

Remember to share this article.

Four Important Things To Know About NMFB Non-interest Banking Window Loan

1. All Credit Facilities which the Non-interest Banking Window of the Targeted Credit Facility TCF are for the purchase of Equipment/Goods ONLY.

2. There is no CASH equipment to the facility.

3. All equipment/goods will be purchased for successful applicants by VENDORS APPOINTED BY NMFB and delivered to the beneficiaries within 48 hours after payment to the vendor.

4. Customers are not expected to pay CASH to any vendor before or after delivery of equipment or goods and vendors are not allowed to provide cash to Applicants.