N915/$: Despite CBN’s New Instructions to BDCs, Naira Crashes in Official, Black FX Markets.

The Nigerian naira once again experienced a decline against the United States dollar in both the official and unofficial foreign exchange markets on August 25, 2023.

Despite the Central Bank of Nigeria’s (CBN) efforts to control activities in the forex markets, the naira continued to struggle against the US dollar in various market windows.

CBN had previously issued a directive on August 17, 2023, outlining operational guidelines for Bureau De Change operations in Nigeria. This directive aimed to maintain a specific trading range for buying and selling dollars, limiting the spread to within -2.5 percent to +2.5 percent of the previous day’s Nigerian exchange market window weighted average rate.

Furthermore, CBN introduced a Foreign Exchange (FX) Price Verification System (PVS) for importers. Despite these measures, the naira’s performance remained unaffected in the Investors and Exporters (I&E), black market, and Peer-to-Peer (P2P) forex market segments.

FMDQ Securities reported that the naira closed at N773.42/$1 in the I&E window on Wednesday, reflecting a drop of N2.70 or 0.35% compared to the previous day’s rate of N770.72/$1. In the P2P market, the naira’s value depreciated by N6 against the US dollar to reach N911/$1, compared to the previous day’s rate of N905/$1.

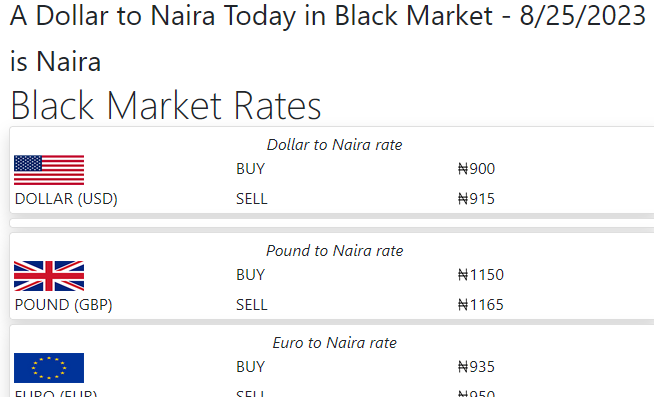

In the parallel market, the naira’s value against the dollar declined by N6 to trade at N900/$1, contrasting with the prior day’s exchange rate of N890/$1. This resulted in an exchange rate gap of N126.5 between the unofficial and official markets.

While the naira briefly gained ground against the dollar, reaching the N800/$1 range in the black market, it appears this increase was largely influenced by the excitement surrounding NNPC Limited’s $3 billion loan.

Dr. Omobola Adu, an Investment Research Analyst at Afrinvest Research and Consulting, shared insights on the situation, predicting that the naira will likely face challenges until at least December 2023. Adu emphasized that boosting dollar liquidity in the foreign exchange market is crucial for the naira’s strengthening. Until there’s an adequate supply of dollars to meet the demand, stabilizing the exchange rate will remain difficult, potentially leading the CBN to tap into its limited reserves. Adu noted that foreign investors are carefully monitoring the market before committing funds, and addressing liquidity concerns is key to attracting their investments. The backlog of payments to foreign companies looking to repatriate revenues also contributes to the liquidity issue. Adu’s outlook suggests that the naira’s rate might stabilize by the end of the current year or early next year, provided that conditions improve as anticipated.