Addresses and Contact Details of Baobab Microfinance Bank In Nigeria

Baobab Microfinance Bank is one of the leading financial institutions in Nigeria, with a presence in over 20 locations across the country. The bank is committed to providing accessible and affordable financial services to individuals and businesses, with a strong focus on promoting financial inclusion in underserved and unserved areas. In this article, we will provide you with the addresses and contact details of Baobab Microfinance Bank’s branches in Nigeria.

List of Baobab Microfinance Bank branches in Nigeria.

| State | Branch | Address | Phone Number | Email ID |

|---|---|---|---|---|

| Lagos State | AJAH (HQ-ANNEXE) | Roxyz Plaza Km 20 Lekki-Epe Expressway, Ilaje Bus-stop, Ajah | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | ALABA | No. 130 Olojo Drive, Alaba International Market Road | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | BROAD STREET | No. 95, Broad Street, Lagos Island | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | IKEJA | Plot 114, Obafemi Awolowo Road, Ikeja | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | IKORODU | No. 41, Lagos Road, Benson Bus-stop, Ikorodu | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | IKOTUN | Nos. 142/144 Ikotun-Egbe Road Cele Bus-stop, Ikotun | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | MUSHIN | No. 21, Palm Avenue, Mushin | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | TRADE FAIR | Block A, Opposite Balogun Gate, BBA Market, Trade Fair | 07000226222 | customercareng@baobabgroup.com |

| Lagos State | YABA | Plot 314, Herbert Macaulay Way, Sabo, Yaba | 07000226222 | customercareng@baobabgroup.com |

| Oyo State | BODIJA | Plot 25b, Bodija Mini Shopping Centre, Bodija Market | 07000226222 | customercareng@baobabgroup.com |

| Oyo State | DUGBE | Baptist Building, Obafemi Awolowo Rd, Oke-Bola, Dugbe | 07000226222 | customercareng@baobabgroup.com |

| Oyo State | EGBEDA | No. 65, Egbeda-Idimu Road Beside Primal Tech Plaza, Egbeda | 07000226222 | customercareng@baobabgroup.com |

| Kaduna State | ZARIA | No. 3 Main Street, near Pz, Zaria | 07000226222 | customercareng@baobabgroup.com |

| Kaduna State | KACHIA | No. 7A, Kachia Road, Kaduna | 07000226222 | customercareng@baobabgroup.com |

| Kaduna State | TUDUN WADA | No. 2 Poly Road,Tudun Wada | 07000226222 | customercareng@baobabgroup.com |

| Kaduna State | KAFANCHAN | No. 9, Kagoro Road, Kafanchan | 07000226222 | customerc |

| State | Branch | Address | Phone Number | Email ID |

|---|---|---|---|---|

| Kaduna State | KAWO | Ra 2, Zaria Road, Hayin Banki, Kawo | 07000226222 | customercareng@baobabgroup.com |

| Kaduna State | CENTRAL | No. 16E Ahmadu Bello Way, CB Finance House | 07000226222 | customercareng@baobabgroup.com |

| Ogun State | ABEOKUTA | Budny Place, Kemta Oloko Itoku Market, Abeokuta | 07000226222 | customercareng@baobabgroup.com |

| Ogun State | SANGO-OTA | No. 20A, Idiroko Road, Sango Ota | 07000226222 | customercareng@baobabgroup.com |

| FCT, Abuja | GARKI | No. 38 Ladoke Akintola Boulevard Garki II | 07000226222 | customercareng@baobabgroup.com |

| FCT, Abuja | NYANYAN | Mararaba Guruku, New Karu LGA, Nasarawa State | 07000226222 | customercareng@baobabgroup.com |

| FCT, Abuja | WUSE | Plot 2135 Herbert Macaulay Way, Wuse Zone 5 | 07000226222 | customercareng@baobabgroup.com |

| Kwara State | Opposite ECWA Chapel, Challenge Roundabout, Ilorin | 07000226222 | customercareng@baobabgroup.com |

HOW TO APPLY FOR BAOBAB Loan ONLINE

- visit the BAOBAB loan portal https://baobabgroup.com/ng/loans/

- Click on “Start Now”

- Fill out the form

- Click “i declare” if you are above 18 years

- Then click submit

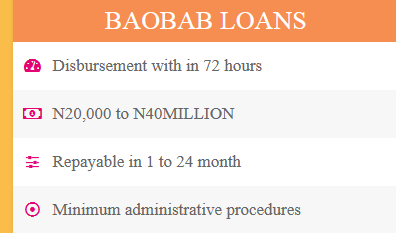

SME loans – They provide a loan of up to 20m to help consolidate or invest in your business, that is repayable in up to 24 months. The loan is for use as working capital or for the purchase of fixed assets.

What Type of Loan does BAOBAB Offer ?

What we offer are business loans for businesses that are already in existence/operation, and housing/house improvement loans.

How Much can you borrow on BAOBAB Loan ?

The minimum loan amount is N20,000 and a Maximum amount of N50,000,000. Both depend on the borrower’s repayment capacity assessed based on verifiable business inventory and other criteria.

BAOBAB Loan Requirements

To access BAOBAB Loan facility, you must have a business, the location must be within our bank’s lending area (Lagos state, Oyo state and Ogun state) and it must have been in existence within a specific period.

If I Apply For BAOBAB Loan, How long will it take to get the Loan ?

It doesn’t take longer than it ought to as long as the necessary requirements are adequately met (less than 3 working days).

visit the official website to apply for Baobab Loan https://baobabgroup.com/ng/loans/

History of Baobab Microfinance Bank in Nigeria

Baobab Microfinance Bank was established in 2005 as Microcred Nigeria Limited, a subsidiary of Microcred Group, a leading international microfinance institution with operations in Africa, China, and Europe. In 2019, Microcred Nigeria Limited was acquired by Baobab Group, a multinational financial services provider with a presence in over ten African countries, Europe, and Asia.

Today, Baobab Microfinance Bank operates in over 20 locations across Nigeria, serving more than 400,000 customers with a range of financial services, including savings and deposit accounts, loans, insurance, and financial advisory services.

The Role of Baobab Microfinance Bank in Promoting Financial Inclusion

Baobab Microfinance Bank is committed to promoting financial inclusion in Nigeria by providing access to affordable and convenient financial services to individuals and businesses in underserved and unserved areas. Through its network of branches and digital channels, Baobab Microfinance Bank is reaching out to millions of Nigerians who previously had limited or no access to formal financial services.

Baobab Microfinance Bank’s financial products and services are tailored to meet the needs of its diverse customer base, which includes low-income earners, small and medium-sized enterprises, and women entrepreneurs. The bank’s savings and deposit accounts, for instance, are designed to encourage a culture of saving among low-income earners and the unbanked, while its loan products are flexible and accessible to SMEs and other businesses in need of capital.

The bank also offers financial literacy and advisory services to its customers, empowering them to make informed financial decisions and improve their financial literacy. By promoting financial inclusion and empowering its customers, Baobab Microfinance Bank is helping to drive economic growth and development in Nigeria.