Best Loan Apps that Don’t Ask for BVN in Nigeria

Do you have an emergency financial responsibility to meet, but payday is still a long way off? Do you need a Loan app that Doesn’t Ask for BVN in Nigeria? The Bank Verification Number (BVN) is an 11-digit unique identification number for every individual in the Nigerian banking industry.

The BVN ensures that you can conduct transactions securely at any Point of Banking Operations in Nigeria. However, some fraudulent loan apps in Nigeria compromise your data and use your BVN for illegal and fraudulent purposes. As a result, you may not want to release your BVN to these fraudulent lending platforms in some cases.

GoldenNewsNg brings you a list of the Best Loan Apps that Don’t Ask for BVN in Nigeria. You can get a loan in Nigeria in minutes with any of them from the top providers we have carefully researched for your consideration. See the following list:

Best Loan App without BVN in Nigeria

This is a list of the best loan app without BVN in Nigeria where you can borrow money from:

1. Carbon Loan App

Carbon which was popularly known as Paylater is another loan app in Nigeria that doesn’t require your BVN to grant you loans.

Carbon doesn’t just offer instant loans, the fintech company offers high-yield savings accounts as well as banking services on its app.

Carbon loan amounts range from N5000 Naira to N1,000,000 Naira with a loan tenure of 7 – 180 days.

As mentioned above, Carbon offers instant loans, so you can expect your account to be funded into your account without delay as soon as the loan has been approved at least within 3 minutes.

2. FairMoney Loan App

You can borrow money using this loan app without BVN in Nigeria. Fairmoney is a top loan platform for getting personal loans in Nigeria. And the best thing? No need to provide your BVN or even collateral to get a loan from Fairmoney

With the Fairmoney loan app, you can get loans of up to N1,000 to N150,000 with a repayment period of 2 – 12 weeks depending on the loan amount. Fairmoeny offers loans based on how creditworthy the borrower is.

3. Jumia Pay

Jumia Pay app is another loan app that doesn’t require BVN in Nigeria for you to lend money from.

To get a Jumia Pay loan, you just need to download the app and navigate to Financial Services and then to the Loans Option. Follow the instructions, provide the information required and you’ll get a loan in minutes without the need for BVN.

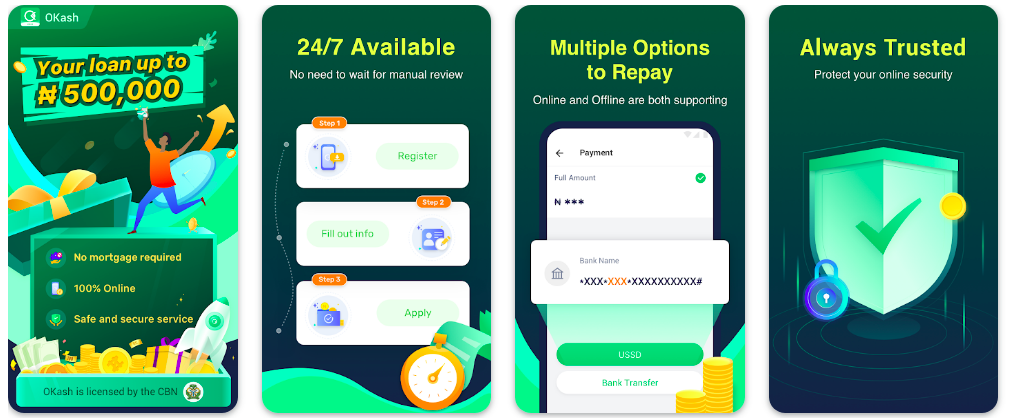

4. OKash Loan App

Formerly Opay’s loan platform, Okash loan which is now operated by Blue Ridge Microfinance Bank Ltd is another loan app without BVN in Nigeria that you can lend money from. You just have to download the Opay mobile app and apply for an Okash loan.

Okash offers up to N500,000 Naira in loans in Nigeria. So you can borrow money from Okash without the need to provide your BVN.

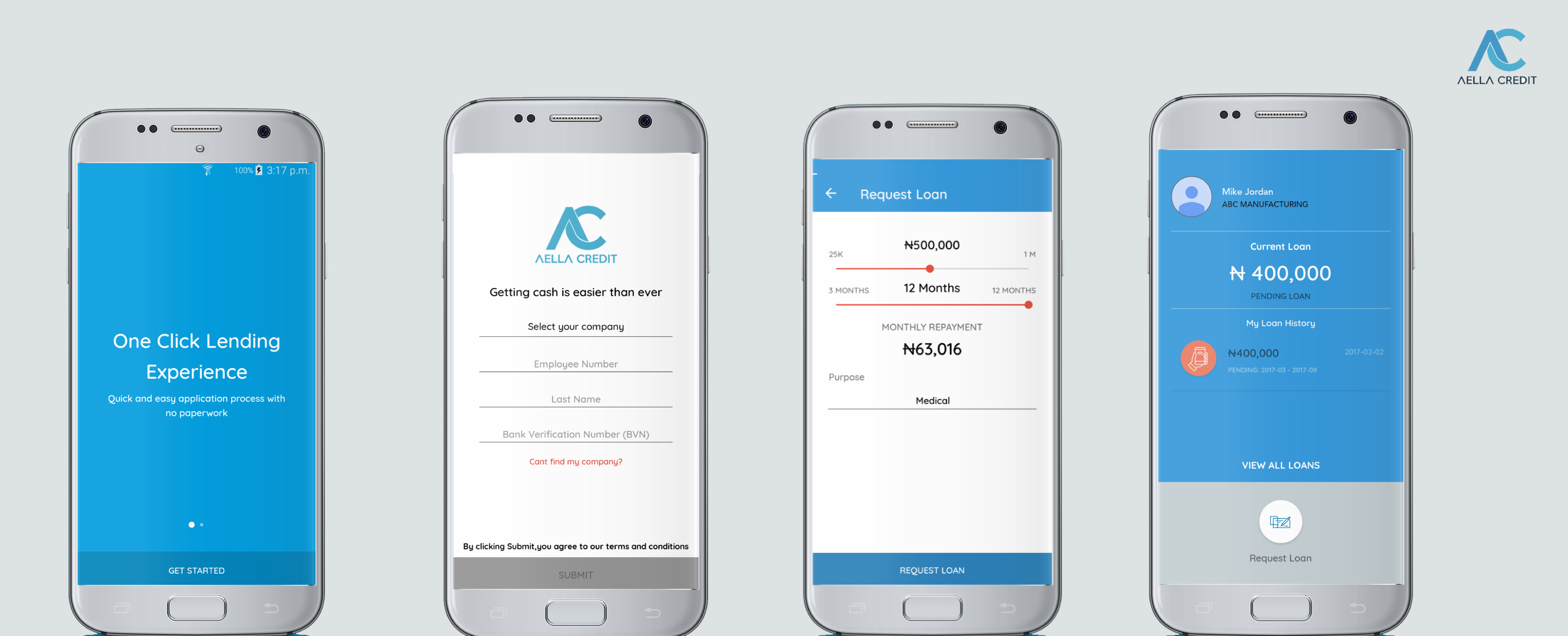

5. Aella Credit

Aella Credit is another popular loan app in Nigeria where you don’t need to provide a BVN to loan money. You can get loans for as low as N2,000 Naira and as high as N1,000,000 Naira.

Aella Credit loans approval and disbursement process is really fast. You can have an Aella Credit loan in your bank account in 10 minutes after applying.

In conclusion, There are loan apps without BVN in Nigeria you can borrow from. You just need to be wary of fake loan apps in Nigeria that charge extremely high-interest rates and can sell your information to third parties. This list of loan apps in Nigeria that don’t require BVN to access a loan is a great starting point for getting loans in Nigeria without proving BVN.