Dollar to Naira Black Market Exchange Rate Today 1st September 2023 can be accessed below.

The current exchange rate for dollar to naira in the black market has emerged and published below.

The dollar to Naira exchange rate remains a topic of significant interest and concern for individuals and businesses in Nigeria. In this article, we will provide you with the latest updates on the Naira to dollar exchange rate in the black market as of 1st September 2023. Stay informed to make well-informed financial decisions in these dynamic times.

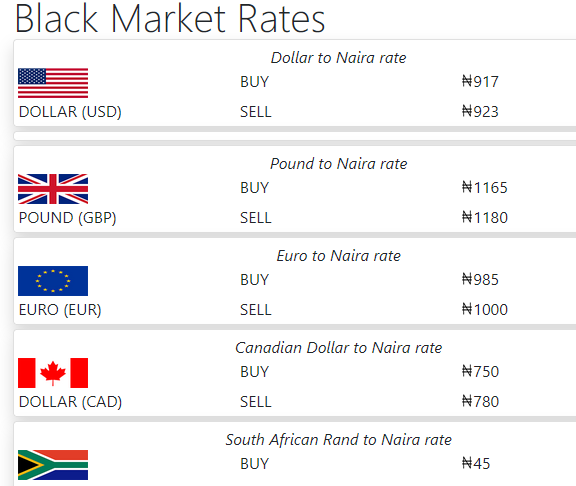

Dollar to Naira Black Market Exchange Rate:

The black market, often referred to as the parallel market, plays a role in shaping the exchange rate landscape in Nigeria. As of today, the 1st September 2023, the dollar to Naira exchange rate stands at ₦917 for buying and ₦923 for selling. However, keep in mind that these rates are prone to frequent fluctuations due to the ever-changing demand and supply dynamics of the currency market.

Factors Behind Exchange Rate Fluctuations:

The dollar to Naira exchange rate is influenced by various factors, each playing a significant role in determining its trajectory:

- Inflation Impact: The inflation rate has a direct bearing on the dollar to Naira exchange rate. A controlled inflation rate can contribute to a stable Naira value, while high inflation can lead to currency depreciation.

- Interest Rates Effect: Central bank-set interest rates are instrumental in guiding exchange rate movements. Higher interest rates can attract foreign investments and boost the Naira’s value.

- Government Debt Influence: The level of government debt can influence investor confidence. High levels of debt might raise concerns about a country’s financial stability, potentially leading to a weaker Naira.

- Role of Speculation: Currency speculators contribute to the volatility of the exchange rate. Their actions based on anticipated gains can lead to abrupt fluctuations in the Naira’s value.

- Trade Dynamics: The terms of trade and trade balance affect the Naira’s strength. Favorable trade conditions can positively impact the currency’s value.

Central Bank of Nigeria (CBN) Perspective: It’s crucial to note that the Central Bank of Nigeria (CBN) does not officially recognize the parallel market. Instead, the CBN directs individuals engaged in forex transactions to approach authorized banks. The official CBN exchange rates may differ from the black market rates mentioned here.

Stay Informed, Make Informed Decisions: As of today, the dollar to Naira exchange rate in the black market is ₦917 for buying and ₦923 for selling. These rates, however, are subject to frequent changes as market dynamics evolve. Staying updated on the latest exchange rates and understanding the driving factors can empower you to navigate the financial landscape effectively.

Disclaimer: The exchange rates provided in this article are sourced from various outlets, including online media platforms. Please be aware that actual rates at the time of your transaction may vary. The currency market is intricate, impacted by numerous variables, and seeking advice from financial experts is recommended before making significant financial decisions.