Latest News On Nirsal Microfinance Bank Loan For Today 19th April 2022 can be accessed below

Welcome to GoldenNewsNg, In this article, we have compiled the latest news on Nirsal Microfinance Bank Loan, including the Covid-19 Loan disbursement update and AGSMEIS Loan Approval to keep you updated.

Below is the Latest News On Nirsal Microfinance Bank Loan For Today 18th April 2022

NMFB Sends New Important Notice To All Loan Beneficiaries

The Nirsal Microfinance Bank has released a new notice to all of its Loan beneficiaries regarding scheduled system maintenance on its banking platforms dated to start on Saturday 16th April to 17th of April 2022.

NMFB made this known on its official social media page, stating that there will be a temporary service disruption on all of its banking channels during the maintenance. They also went further to apologize to all beneficiaries for any inconvenience this might cause.

Nirsal Microfinance Bank Pledges More Support For SMEs And Sports

GoldenNewsNg reports that Nirsal Microfinance Bank has pledged to continue supporting SMEs and Sports in the country despite complaints from Loan applicants regarding lack of loan approval.

This was disclosed by the Managing Director of NIRSAL Microfinance Bank, Mr. Abubakar Kure, on Sunday, who stated that the bank would continue to support businesses to fast track the growth of Small and Medium Scale Enterprises (SMEs) in the country.

Kure said this in Abuja on the sideline of a novelty football match to mark the third year anniversary of the strategic bank.

He told the News Agency of Nigeria (NAN) that the bank will continue to work with relevant stakeholders to fast track the growth of SMEs across the country.

Kure said the novelty match was organized by the bank as part of activities to mark its third year anniversary and also to informally interact with members of staff.

Nirsal Microfinance Bank Marks 3years Anniversary

Nirsal Microfinance Bank has reached three years of successful operation, three years of changing lives as they marked their Anniversary today.

According to NMFB:

“Today marks the 3rd Anniversary of NIRSAL Microfinance Bank Indeed! It’s been THREE YEARS of changing lives. THREE YEARS of reaching out to the unbanked across the country, transforming and sustaining the growth of Small Business Enterprises in Nigeria.”

“It’s been THREE YEARS of disbursing: Over 350 billion naira Covid-19 loans; More than 13 billion naira Non-Interest-Banking loans; Close to 2 billion naira Nigeria Youth Investment Fund loans, A little over 117 billion naira AGSMEIS loans; and Close to 39 billion naira Anchor Borrowers Programme loans to beneficiaries nationwide. Happy 3rd Anniversary NMFB!”

CBN Cuts Interest Rate On Intervention Loans To 5%

Following the ongoing global economic crises over the Coronavirus (COVID-19) the Central Bank of Nigeria (CBN) has announced the reduction of interests rate on its intervention loans from nine percent to five percent, as well as, an extension of the moratorium from one to two years, to buffer the Nigerian economy.

The CBN Governor, Mr. Godwin Emefiele, who disclosed this at a press briefing in Abuja, yesterday, said that the measures were the bank’s first set of responses to the COVID-19 global crisis, which has adversely affected businesses in many sectors across the world.

He also announced a N50 billion additional fund for the NIRSAL Micro Finance Bank for on-lending to Small and Micro Enterprises.

Dubious NIB Vendors To Face Punishment

The Managing Director of the Nirsal Microfinance Bank, Abubakar Abdullahi Kure has warned its approved vendors of the Non-Interest Banking Window for TCF & AGSMEIS Loan who engage in any unethical Practices will be handed over To Law Enforcement Agencies.

Mr. Abubakar Abdullahi Kure disclosed this during a recent meeting of the Bank on the Loan Programme on Friday.

Kure who appraised the Bank’s accredited vendors for Non-Interest Banking window for TCF & AGSMEIS, tabled various complaints from aggrieved beneficiaries at the event which was attended by over fifty vendors from different parts of the country

CBN Disburses N159.21 Billion to 330,128 Women

The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele has stated that its office has given a sum of N159.21 billion to 330,128 females under the NMFB Targeted Credit Facility (TCF) designed to support household and Micro, Small, and Medium Enterprises (MSMEs) affected by the COVID-19 pandemic.

The Governor disclosed this, at the ‘Gender Equality Today for a Sustainable Tomorrow’ event in Abuja.

NMFB Starts New Disbursement Of Covid-19 TCF Loan To Approved Beneficiaries

If you are one of the Nirsal Microfinance Bank Covid 19 TCF Loan Successful beneficiaries, you will be happy to know that NMFB has finally started fresh disbursement Covid-19 TCF loan to approved beneficiaries.

This was disclosed on one of the Nirsal Microfinance Bank Facebook groups by beneficiaries who expressed their happiness after recently receiving an alert of their Loan from Nirssal Microfinance Bank…

Nirsal Microfinance Bank Sends New Notice To Applicants On Loan Approval

The Nirsal Microfinance Bank NMFB has warned all Covid-19 Targeted Credit Facility or AGSMEIS loan applicants to ignore any loan approval message demanding them to pay money in order to secure their Loan.

NMFB disclosed this on their official Facebook page where they stated that the fraudsters are currently circulating fake approval messages, extorting money from applicants.

They went further to warn all applicants that NMFB will not ask for money in order to access Covid-19 Targeted Credit Facility or AGSMEIS Loan.

NMFB NIB Vendors Continues Disbursement Of Equipment To Loan Beneficiaries

Nirsal Microfinance Bank has disclosed photos of Non-Interest Banking window beneficiaries receiving their items from their various vendors which were assigned to them during their loan approval.

The photos which were disclosed on their official Facebook page showed Non-Interest Banking window Loan beneficiaries receiving their equipment from their vendors. Read More

Nirsal Microfinance Bank Sends Important Notice To NIB Applicants

Nirsal Microfinance Bank has sent a new notice to Non-Interest Banking window applicants through their official Instagram account regarding the disbursement of their equipment.

According to NMFB

“IMPORTANT NOTICE FOR NIB APPLICANTS

“DO NOT sign any vendor’s Asset/goods acceptance note or invoice until you confirm that the goods you originally requested for match what is being delivered.”

Beneficiaries are to take note of the above notice to avoid complications in receiving their equipment.

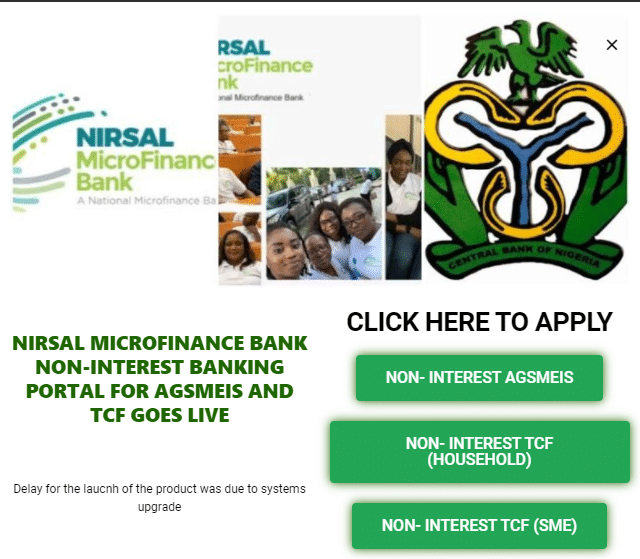

However, Nirsal Microfinance Bank Non-Interest Banking window loan application is still ongoing for new applicants. Read Nirsal CBN Non-Interest TCF Credit Application Portal (Household)

Over 40 NMFB AGSMEIS Beneficiaries Empowered With Mahindra Tractors

Nirsal Microfinance Bank has revealed that over 40 NIRSAL Microfinance Bank’s AGSMEIS beneficiaries were recently empowered with Mahindra Tractors for their farming activities.

NMFB disclosed this today on their official Twitter account, stating that the gesture was aimed at complementing Federal Government’s/CBN’s effort to boost mechanized farming.

According to NMFB

“Over 40 NIRSAL Microfinance Bank’s AGSMEIS Beneficiaries were recently empowered with Mahindra Tractors for their farming activities. The gesture was aimed at complementing Federal Government’s/CBN’s effort to boost mechanized farming.”