Latest News On Nirsal Microfinance Bank Loans For Today Monday 13th December 2021

Welcome to GoldenNewsNg, we have gathered all the latest happenings on the Nirsal Microfinance Bank Loans which we will be sharing with you in this article, so make sure you read until the end.

1. Successful Completion of AGSMEIS Application Process is Not A Guarantee For Loan Approval – NMFB

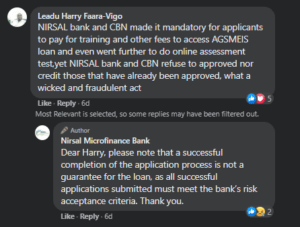

Nirsal Microfinance Bank has revealed that successful completion of the AGSMEIS application process is not a guarantee that the beneficiary’s loan will be approved.

NMFB disclosed this on their official Facebook page when replying an angry AGSMEIS applicant who narrated how he has paid and undergone the necessary AGSMEIS training and also went further to do an online assessment test but yet his Loan is not yet approved.

Replying to the applicant, NMFB stated:

“Dear Harry, please note that successful completion of the application process is not a guarantee for the loan, as all successful applications submitted must meet the bank’s risk acceptance criteria. Thank you.”

However, the AGSMEIS Loan portal is still open for new applications, to get full details and procedures on how to apply, kindly click HERE

2. APSAN Visits Nirsal Microfinance Bank MD, Commends The Bank’s Effort

The officials of the Agricultural Produce Sellers Association of Nigeria (APSAN) paid a visit to the Executive Director of Nirsal Microfinance Bank, Mr. Darlington Lawson at the Head Office of NIRSAL Microfinance Bank.

This was disclosed by Nirsal Microfinance Bank through their official Instagram account where they stated that the President of APSAN, Comrade Aloys Akortsaha commended the bank’s effort in ensuring that Agribusiness dealers were empowered through intervention funds like the Covid-19 Targeted Facility (TCF), AGSMEIS loan and the Anchor Borrower’s Program.

According to him, “it is the first time in the history of Nigeria that a programme or policy affects the grassroots directly without influence by powers that be.” He revealed that so far, over 20,000 farmers have benefited from the loan scheme.

Mr. Darlington Lawson appreciated the group for recognizing the impact of the intervention loan on their members.

3. NMFB Urges Beneficiaries To Start Paying Back Their Loan

Nirsal Microfinance Bank has urged beneficiaries whose Loans are due to start paying back their loan, stating that the programme is not a national cake.

This was disclosed by the Managing Director of Nirsal Microfinance Bank, Mr. Abubakar Abdulahi Kure, who stated that the Loan is essential to help those at the lower level of the economy. The idea is to create jobs, provide and create affordable and accessible loans and also grow the economy effectively.

He also made it clear that people think this is a public fund. There is a poor perception around it, which could pose a danger to recoveries. Some people feel it’s a national cake. There would be challenges around recoveries. We also have scammers around the products. Because people are desperate; because demand supersedes supply and the fund is limited, people get scammed.

He went further to urge those whose Loan is due to start paying back in order to help others whose Application are yet to be approved.

That’s all for the Latest News On Nirsal Microfinance Bank Loans For Today Monday 13th December 2021, make sure to share this article and always come back from time to time for more updates.