Niger reduces Tax to ease businesses amidst COVID-19

Following the effect of the COVID 19 (Coronavirus) lockdown which has affected businesses adversely, the Niger State Government said it has approved reduction of Tax payment in the State.

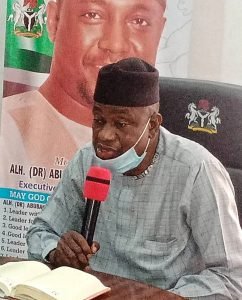

Making this known, Secretary to the State Government, Alhaji Ibrahim Ahmed Matene said the gesture will cushion the economic impact of the Coronavirus pandemic in the state.

Matene who is also chairman of COVID 19 taskforce in the State while addressing Journalists at the Government House, Minna on behalf of Governor Abubakar Sani Bello said the Tax reduction takes effect from 24th of June, 2020 to 31st March, 2021.

According to him “the filling date of annual tax returns by all businesses and individuals have been extended to 30th September, 2020 while the filling of monthly PAYE returns by businesses has been granted 10 days extension beginning from the 10th to 20th of every month.”

He stated that the penalties and interests on late fillings, payments, and remittances as well as default on Tax liabilities have been reviewed downward to 5% percent for penalties and 10% percent for interests charges.

Matane disclosed that Government has granted 50 percent reduction on all rates as contained in the Harmonized Agricultural Produce and Livestock Fees Collection Regulation Act 2019.

Payments in four (4) installments have been granted to all Tax payers in the Small Medium Enterprises SMEs and the Informal sector.

He assured that all the Agencies responsible for collection of Tax have been notified on the development, hence anyone shortchange should forward their complaints to the office of the Secretary to the state government.

He however urged the general public to continue to adhere strictly to all COVID-19 protocols by the State Taskforce on COVID-19.

END