How to Detect Fake Bank Alerts: Have you ever been cheated by a fake alert? If you haven’t already, this post is for you. Continue reading to the end to learn how to detect a fake bank alert.

Many Nigerians have fallen victim to a fake bank alert scam. A real-life example occurred in my area of Edo State involving a POS business owner named Osadolor. A young man visited his shop and sent a fake bank alert for N50,000 to Osadolor’s account. Osadolor received a confirmation alert but later discovered that the money was never actually deposited into his account, and the scammer had already left the shop.

To prevent similar incidents from happening to you, GoldenNewsNg has published an informative article on how to detect fake bank alerts and how they are carried out. The article covers various topics, which you can navigate using the following links:

How to Detect Fake Bank Alert?

It’s possible that you may feel like scrolling past this information, thinking it’s unnecessary. However, understanding the red flags is crucial, especially for those who have experienced the pain of having their hard-earned money stolen without any trace. Such victims know the importance of being vigilant and identifying warning signs that others might miss.

It’s important to note that this can happen to anyone, so to avoid becoming a victim, it’s essential to keep an eye out for the following indicators.

- Check out for misspellings.

- They will ask for your account number which is not out of place, and also ask for your phone number, and THAT is out of place. That’s a red flag. No one needs your phone number to send you money.

- Your account balance will not be credited. The real bank alert will show you how much you had before the alert and after the alert.

- Have a precise knowledge of how much was there before, and if it corresponds with the previous amount then you’re on track. If not you might just be about to be scammed.

- If you were sent a mail, check the email source and look out for the official email address of your bank.

- Check the authenticity of the mobile app used.

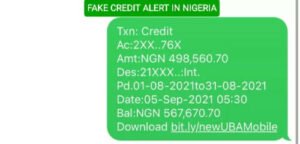

Let me show you how fake bank alert looks like,

Credit Alert!

Acc#: xx0*******xx45

Amt:30,000

Desc: 00100001000

Diamond Bank

Nurudeen Ojo

Time: 20/10/21/10:00PM

Avail Bal: 100.000.09

Total Bal: 100.00.10

This is what the Diamond bank alert format appears to be. Scammers may use this format to send you fake bank alerts that closely resemble genuine ones

This is How to Detect Fake Bank Alerts

- First of all, any time your receive alert, Check the message where its located, maybe its located to inbox where your bank real message use to be. If its not among the other, its means something is wrong

- Secondly, Check whether the amount sent top up your balance. If not, it fake alert be that, because they cannot know the total amount in your bank account

- Thirdly, check the alert format, because some of them dont know all bank formats

- And lastly, check your account balance. It is adviceable to use your bank mobile app so that anytime money is sent to you, you will quickly login to the mobile app to confirm the payment.

Codes To Check Bank Account Balance

- Access bank *901*5#

- Eco-bank *326*0#

- Fidelity bank *770*0#

- First bank *894*0#

- FCMB *329*00#

- GT bank *737*6*1#

- Heritage bank *322*030#

- Stanbic bank *909#

- Keystone bank *7111*1#

- Sterling bank *822*00#

- UBA bank *919*00#

- Unity bank *7799#

- Wema bank *945*0#

- Zenith bank *966*00#

How does Fake bank alert done?

bulk sms is used in this process. Bulk SMS is an act of sending message to large number of people, its less expensive and easy to use.

When this scammers get the information they need to perform this fake bank alert, the will do it successfully. So, to avoid been scammed by this people, you need to hide that information from them. And if by any means, this information is review to them, there is a way you can detect fake alert.

What information do these fraudsters need to send you fake bank alert?

1. Your phone number

2. Your account number

Without the above information, it is impossible for them to send you fake messages, and when you eventually figure out what they’ve done, it would be impossible to track them.

The reason is, they have a dedicated SIM card for perpetrating this evil. They figure out the format that your bank uses to send you credit or debit alerts, and copy to send to you.

How to Avoid fake bank alert

After anyone claims to have sent money into your bank account ensure you confirm with the necessary account linked to your bank account , the first account is Email.

1. Check your email

Check your email that is linked to your bank – the one that is registered with your bank. If you don’t have an email for bank alerts, then you can open one and link it to your account to help you clear your doubts about the financial transaction that took place.

With this email, you also get access to your bank statement and your account balance, all in your email.

Once you received the suspected bank alert, check your email source.

2. Check account Balance

This can be done using your bank USSD code or mobile banking app, you can also check your account balance through internet banking or ATM machine. A fake bank alert will never reflect in your account balance or statement.

3. Check the credit alert you received if it contains your available bank

Fake bank alerts will not contain your available balance so you can easily detect the fake alert if your account balance does not reflect along with transfer payment done by your customers/buyers.

4. Avoid clicking on links that request your bank account details or given out your bank information to stranger either via email, phone call or online platform. Be warned and stay safe.

Conclusion:

This post is written to answer many search queries such as ‘how to send fake bank alert in Nigeria, Fake bank alert SMS in Nigeria, Free fake alert, Union Bank fake alert code, Fake transfer, how to know fake bank alert, Fake bank credit alert, Code for fake transfer, Zenith Bank fake alert, Gtbank fake bank alert, access Bank fake bank alert and etc.

please be aware of fake bank alert and I hope you find this article helpful? If so, share to your friends and family to keep them aware of bank alert scam